FDI Troubles

Foreign investment strategies need review and investment parks in Viet Nam are under-performing according to the news in 2012. These trends challenge the government of Viet Nam:

- Steep decline in Foreign Direct Investment (FDI) for 2012.

- Inability to meet targets for reinvestment as a set percentage of the revenues of foreign companies into local Research and Development (R&D).

- Low investment in high-technology fields.

- Legacy technology companies displace targeted high-technology companies.

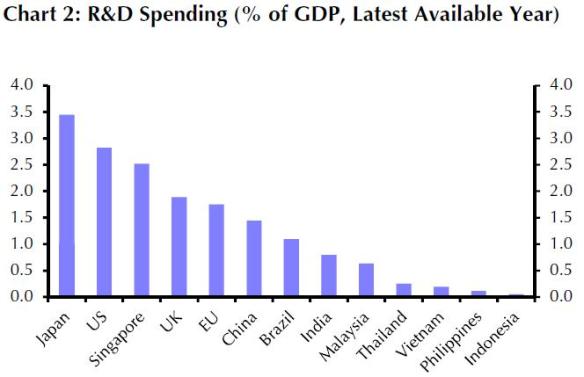

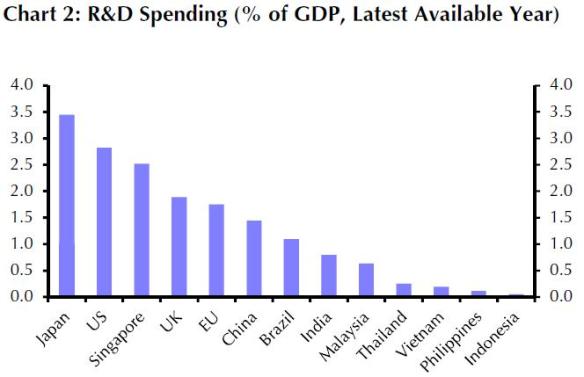

R&D Spending (% of GDP, Last Available Year)

Viet Nam in the Lowest Tier

Source: World Bank and Financial Times

Government Recognizes the Problem

The Minster of Planning and Development, Bui Quang Vinh, said at a recent VIR workshop,

“Our adjusted policy and incentives must match our target of attracting high quality FDI [into Vietnam].”

Nguyen Van Lang, MoST deputy minister, told the same audience that current policies for attracting FDI were “inadequate”. This was particularly true in the high-tech sphere. The government needs to act, he said,

“It’s time to review and reassess incentives and regulations on high-tech investments”

Clustering

Harvard Business School Professor Michael E. Porter, an expert on competition and global competitive advantages, has long advocated the power of “clustering.”

You may be familiar with or are working on “clustering” to raise FDI levels, increase domestic R&D expenditures, and attract knowledge-based companies.

I’ve researched “clustering” and work with knowledge-based companies that benefit from clustering.

Here are some key points from some pertinent scholarship. The source articles are cited at the end of this post.

Clusters Defined

Clusters are concentrations of highly specialized skills and knowledge, institutions, rivals, related businesses, and sophisticated customers in a particular nation or region. Proximity in geographic, cultural, and institutional terms allows special access, special relationships, better information, powerful incentives, and other advantages in productivity and productivity growth that are difficult to tap from a distance.

Impact on a Knowledge-based Economy

[N]ew influences of clusters on competition have taken on growing importance in an increasingly complex, knowledge-based, and dynamic economy.

Roles of the Players

Clusters represent a new way of thinking about national, state, and local economies, and they necessitate new roles for companies, for various levels of government, and for other institutions in enhancing competitiveness.

Attracting FDI and Export Trade

Clusters are a driving force in increasing exports and are magnets for attracting foreign investment. Clusters also represent an important forum in which new types of dialogue can and must take place among companies, government agencies, and institutions such as schools, universities, and public utilities.

Clustering is not the same as a National Industrial Policy

A role for government cluster development and upgrading should not be confused with the notion of industrial policy. … Industrial policy tends to centralize intervention decisions at the national level. … Cluster theory could hardly be more different. The concept of clusters rests on a broader and dynamic view of competition among firms and locations, based on the growth of productivity.

Clustering and Employment

We find that clusters contribute to the level of employment in young start-ups in regional industries, suggesting that a strong cluster environment in a region enhances the performance of start-ups.

Quotations taken from:

Delgado, Mercedes, Michael E. Porter, and Scott Stern. “Clusters and Entrepreneurship.” Journal of Economic Geography; 10.4 (2010) : 495 -518.

Porter, Michael E. “Location, Competition, and Economic Development: Local Clusters in a Global Economy.”

Economic Development Quarterly 2000; 14; 15 DOI: 10.1177/089124240001400105

Conclusion

Clusters could be a driver to reach and exceed the govenment’s FDI targets and development goals. Government policy appears to move in that direction, as provincial authorities get more power to manage foreign investments. Whether the government understands the power of clustering is an open question.